Inflation came in higher than expected in January, ratcheting up pressure on the Bank of England to hike interest rates as soon as May.

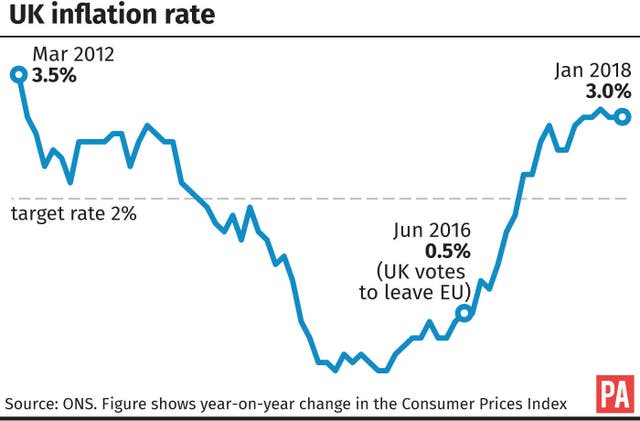

Figures from the Office for National Statistics (ONS) show the Consumer Prices Index (CPI) rate of inflation came in at 3% in January, unchanged from December, but lower than the most recent peak of 3.1% in November.

Economists were pencilling in a drop to 2.9%.

Ben Brettell, a senior economist at Hargreaves Lansdown, said it would have marked the first step towards bringing inflation back to the Bank’s 2% target.

“But in fact the rate remained at 3.0%, with price rises driven by clothing, footwear and recreational goods/services.

“Inflation’s now been above target for 12 straight months. This adds further weight to the case for higher interest rates sooner rather than later,” he said.

Mr Brettell said it now looks like the next rise “may well happen in May”.

“Indeed Bank of England policymakers said last week they’ll try and bring inflation back to target more quickly than previously expected, which means rates could rise faster and further than anticipated.”

Higher inflation has been fuelled in part by the Brexit-induced collapse of the pound, which has made imports more expensive and driven up the cost of living, adding pressure on households squeezed by paltry wage growth.

While ONS reported signs of weaker price rises for fuel and food in January, those were offset by a shallower fall in leisure costs.

After rising strongly since the middle of 2016, food price inflation now appears to be slowing https://t.co/CQ8CQhZBel

— ONS (@ONS) February 13, 2018

ONS senior statistician James Tucker said: “Headline inflation was unchanged with petrol prices rising by less than this time last year.

“However, the cost of entry to attractions such as zoos and gardens fell more slowly,” he explained, as ticket prices tend to fall at the start of the year.

At the pumps, petrol prices rose by 1.1p per litre on the month to 121p per litre, while diesel rose 1p to 124.5p per litre.

Food price inflation also appeared to be slowing, having risen strongly since mid-2016, edging down 0.1% on the month amid larger falls in the cost of meat, oils, milk, cheese and eggs.

Sterling rose 0.5% against the dollar to 1.39 US dollars following the news.

Against the euro, the pound was trading flat at 1.12 euros.

Clothing prices helped to prop up the inflation figure despite having fallen 3.7% month on month, which marked a weaker drop compared to the 4.3% fall during the same period a year earlier.

Airfares, which usually fall after the holidays, also dropped at a slower rate, down just 33.2% month on month, compared to a 36% drop a year earlier.

Tobacco costs, meanwhile, grew faster at 0.4% month on month which was likely due to the remainder of duty price hikes coming through after being introduced in November.

The Consumer Prices Index including owner-occupiers’ housing costs (CPIH), the ONS’ preferred measure of inflation, held steady at 2.7% in January, unchanged from the month before.

#UK #consumer #price #inflation sticky in January as holds at 3.0%. Only marginally down from peak of 3.1% in November (highest since March 2012). Core inflation back up to 2.7% in Jan after dip to 2.5% in Dec. Will likely fuel expectations of #BOE #interest #rate hike in May

— Howard Archer (@HowardArcherUK) February 13, 2018

Chris Williamson, chief business economist at IHS Markit, said inflation is likely to remain “stubbornly high for some time to come”, but warned that an interest rate hike should not be taken for granted.

“While the door remains open for a May interest rate hike, the Bank of England will likely need to see indicators of the economy’s health improve to be sufficiently reassured that the economy is ready for another rise in borrowing costs.”

The Retail Prices Index (RPI), a separate measure of inflation, edged lower to 4.0% last month from 4.1% in December.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here